Think about: You’re the proprietor of a small however fast progress. He has simply launched a brand new product, and prospects world wide have began actively shopping for it. However there’s a downside: a few of their prospects need to pay with cryptocurrency.

You’ve heard of Bitcoin, Ethereum and different digital property, however you might have by no means skilled earlier than utilizing them. How is fee accepted? The place do you retailer these funds? And, most significantly, how do you do it safely and handy for your corporation?

That is the place cryptographic wallets Provide rescue. However how to decide on the precise pockets sort? In spite of everything, there are two most important varieties: custody and non -custody encryption wallets. One in every of them is extra appropriate for learners and the opposite, for many who admire whole management over their property.

On this article, we’ll break down what a cryptocurrency pockets is and the way it works in order that it could settle for, ship and simply retailer cryptocurrencies. We will even allow you to perceive the very best pockets to select from, both for private or enterprise use.

On the finish of this text, you’ll have a transparent understanding of which possibility is sufficient for you and it is possible for you to to combine with confidence the cryptocurrency in your industrial processes.

What’s a non -custodial pockets?

Think about that he doesn’t keep his financial savings in a financial institution, however in your personal security field, to which solely you might have a non-public key. Nobody however you’ll be able to entry your cash. That is precisely how a non -custodial pockets works. It’s a digital device that offers you full management over your cryptographic property.

How does it work?

A cryptographic pockets with out custody doesn’t save your cash on exterior servers. Relatively, it provides you a non-public key and particular codes that mean you can management your property within the block chain. You select the place to maintain these non-public keys, learn how to use them and when to make use of them.

Non -custodial pockets advantages

- Full management: You’re the solely proprietor of your funds. Nobody can block their pockets or limit entry to it.

- Elevated safety: Since its keys are usually not saved in third -party servers, the chance of piracy is significantly diminished.

- Anonymity: Their information and transactions stay non-public, since they don’t share them with third events.

Uncover us from custody wallets

- Safety accountability: If you happen to lose your non-public password or seed phrase (restoration phrase), entry to your funds can be misplaced perpetually.

- Issue for learners: Managing keys and transactions could be difficult for these new in cryptography.

Examples of non -custodial wallets

- Metamk: A well-liked pockets to work with headquarters in Ethereum and Ethereum.

- Belief pockets: Common cellular pockets with help for a number of cryptocurrencies.

- Ledger Nano S/X: {Hardware} wallets that present most security when storing out -of -line keys.

What’s a custody pockets?

Go on a visit and resolve to not put on your complete money with you, however depart it on the secure resort. The workers retains the secure of the secure and also you belief them to maintain your cash secure. A custody pockets works roughly in the identical approach.

It is a sort of pockets the place a 3rd, corresponding to an encryption or trade service, shops its non-public keys and manages its funds in its identify.

How does it work?

In a custody pockets, you haven’t any direct entry to your non-public key. Relatively, the service supplier retains them secure and takes care of all of the technical points of administering its cryptographic property.

Entry your funds by a handy interface, corresponding to an software or web site, and the provider handles every part else. Use a custody pockets when you want consolation and belief a 3rd.

Advantages of custody wallets

- Ease of use: Excellent for learners who desire a easy and direct solution to deal with their cryptography.

- Restoration choices: If you happen to overlook your password, the provider will allow you to get better entry to your account.

- Further traits: Many custody wallets additionally provide built-in providers corresponding to commerce, bets and loans, which makes them a single -use answer for cryptography customers.

Uncover us from custody wallets

- Safety dangers: Because the provider has its non-public key, its funds are weak to hacks or poor administration.

- Lack of management: Belief the provider’s coverage, which can embrace freezing your accounts or limiting retreats.

Examples of custody wallets:

- Coinbase: A well-liked custody pockets supplier with a usable interface.

- Binance: Identified for its wide selection of providers, together with a custody pockets to commerce and retailer cryptography.

- Kraken: One other trusted platform that gives custody pockets providers along with superior industrial traits.

What’s the distinction between custody and no custody wallets?

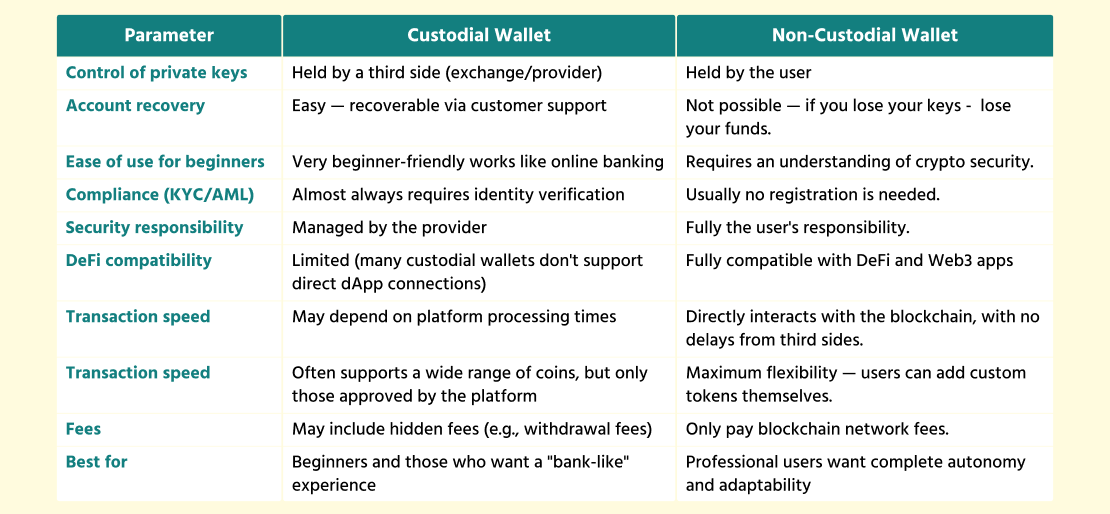

That can assist you higher perceive the distinction between non -custodial and non -custodial wallets, now we have ready a transparent comparability desk.

This common description backward and forward highlights who controls their funds, how secure every possibility is, how simple they’re for use and what sort of pockets may very well be the very best as a substitute relying on their wants, no matter whether or not you’re on the lookout for the very best pockets for private use or a pockets for enterprise.

Here’s a detailed comparability of key traits and capabilities:

Custodial vs non -custodial pockets

Cryptocurrency Pockets Growth Providers

If you happen to like Create your personal cryptocurrency pocketsGrowth providers may help you make this concept come true. Whether or not you want a cryptographic pockets of straightforward custody for comfort or a non -custodial pockets for whole management over their property, skilled builders will provide an answer to satisfy their wants.

What’s normally included in such wallets?

- Assist for common cryptocurrencies corresponding to Bitcoin, Ethereum and Tokens ERC-20.

- Integration with blockchain networks and defi platforms for superior traits.

- Strong safety: two elements authentication (2FA), encryption and different safety measures.

- Straightforward to make use of interface that works for each cellular units and computer systems.

Cryptographic exchanges improvement

Cryptographic exchanges They’re the guts of the cryptographic economic system, the place the place customers purchase, promote and trade digital property. If you happen to plan to create your personal trade, improvement providers may help you perform this challenge.

What’s vital when creating an trade?

- Commerce motor: A quick and dependable system that may deal with 1000’s of transactions per second.

- Liquidity: Integration with massive liquidity teams in order that customers can commerce with out delays.

- Safety: Chilly storage of funds, safety in opposition to assaults by laptop pirates and compliance with KYC/AML.

- Comfort: Easy and clear interface that may adapt to each retailers and skilled retailers.

The exchanges are available two varieties: centralized (CEX) and decentralized (DEX). Centralized exchanges are handy for learners and provide excessive liquidity, whereas Decentralized exchanges Give extra freedom and management over your property.

Ultimate ideas

The selection between a custody or non -custody pockets is dependent upon whether or not you’re a common person, a cryptographic investor or an organization that seeks a dependable device to work with digital property.

Sure you I want a cryptographic pockets For enterprise, particularly if the corporate operates in a really regulated jurisdiction, it’s higher to look at the options or wallets of custody as a service.

These are key key platforms with KYC/AML help, constructed -in fiduciary bond doorways and the flexibility so as to add industrial traits starting from a number of customers to automated stories and tax authorities.

In case your goal is private use, most freedom and entry to decentralized providers, then self -odial wallets are your alternative. These wallets present whole management over non-public funds and keys, mean you can work straight with the Defi protocols, connect with web3 functions and add any tokens manually. Everybody will discover their professionals and cons.

To sum up:

- A cryptographic pockets for firms or wallets as a service with an strategy in comfort, security and compliance.

- For private use and lovers of energetic cryptographic: self -odial wallets with whole management and most freedom.

- For learners and people who need simplicity and help: custody wallets of the primary exchanges.

Every answer is sufficient to your personal duties, and the primary factor is to grasp what priorities are most vital to you: management or comfort, safety of freedom or error, autonomy or ready infrastructure.

Frequent questions

Is it potential to switch funds from a custody pockets to a non -custodial pockets?

If potential. You’ll be able to withdraw your funds from a custody pockets to a custody pockets by coming into the path of your non -custodial pockets.

How do non -custodial security wallets present with out server?

Non -custodial wallets use cryptography to guard non-public keys. These keys are solely saved on their machine, eliminating the chance of servers being compromised. The usage of wallets with out custody requires extra person accountability because it manages and ensures your non-public keys your self.

Can I take advantage of a non -custodial pockets to rethink or decentralized finance (defi)?

Sure, many non -custodial wallets, corresponding to Metamk or the trusted pockets, admit the rethinking and integration with defi platforms.

Can I return to a non -custodial pockets and not using a seed phrase?

No, seed phrase is the one solution to get better entry to a non -custodial pockets. If you happen to lose it, cash can be inaccessible.

What’s a cryptographic pockets and the way does it work?

A cryptographic pockets is a tool to retailer, ship and obtain cryptocurrencies. It really works by managing non-public and public keys: the non-public key gives full entry to its funds, and the general public secret is the pockets deal with the place it could obtain transfers. Some wallets (custodial) retailer the keys to you, whereas others (with out custody) put the management fully in your fingers.

Custodial vs non -custodial wallets. How do you select from them?

The professionals, in addition to the cons of every possibility, are vital to have in mind in the case of selecting a pockets saved or not saved. Uninformed wallets mean you can fully management your encryption property, however indicate better accountability. Castilla wallets, however, provide comfort and help, however require confidence within the digital pockets provider.